Content

- Financial Accounting Course

- Accounting Help With Posting Transactions

- Steps in Posting in Accounting

- Recording transactions in the journal and posting to the ledger

- What Method Is Used to Detect Errors When the Two Columns of the Trial Balance Are Not Equal?

- What is posting in accounting?

- Accounting and the Importance of Adjusting Entries

The Cash account is debited on December 1 for the $30,000 owner investment, yielding a $30,000 debit balance. The account is credited on December 2 for $2,500, yielding a $27,500 debit balance. On December 3, it is credited again, this time for $26,000, and its debit balance is reduced to $1,500. The Cash account is debited for $4,200 on December 10, and its debit balance increases to $5,700; and so on.

- On this transaction, Cash has a credit of $3,500.

- The trial balance is a listing of all account balances.

- If you wanted a company to reimburse you for the meal because you were traveling on company business, you must present evidence of your expenditure.

- Generally, most organisations or small businesses prefer these types of ledger.

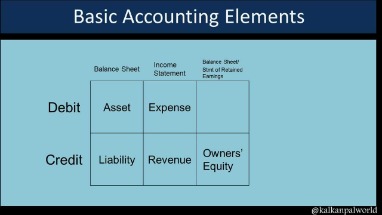

It explains the transfer of amount from journal to ledger or balance of various accounts to the general ledger to make it simple to understand. The amount is to be shown in the amount column, the debit balance is to be debited, and the credit balance is credited on the credit side. Double EntriesThe double-entry accounting system refers to the double effect of every journal entry. Debit and Credit and this principle states that for every debit, there must be an equal and opposite credit.

Financial Accounting Course

For example, investors want to see the income and liabilities you posted in the general ledger to evaluate the health of the company. Investors are not concerned with the information you recorded in your accounting journals. Firstly, The profit and loss account statement includes the cost of goods sold, sales, depreciation expense, marketing and advertising expenses, taxes and interest. Whereas the balance sheet counts account receivable, bonds payable, retained earnings, cash, accounts payable, accumulated depreciation, and common stock. Therefore, it becomes necessary for the accountant to segregate the account category.

For example, Cash has a final balance of $23,600 on the debit side. This balance is transferred to the Cash account in the debit column on the trial balance. Accounts Payable ($3500), Unearned Revenue ($4000), Share Capital ($20000) posting in accounting and Revenue ($5500) all have credit final balances in their T-accounts. These credit balances would transfer to the credit column on the trial balance. In the journal entry, Utility Expense has a debit balance of $300.

Accounting Help With Posting Transactions

You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Full BioMichael Boyle is an experienced financial professional with more than 10 years working with financial planning, derivatives, equities, fixed income, project management, and analytics. Had a total of $1,288,500,000 in stored value card liability. You have the following transactions the last few days of April.

- All accounts arising from business transactions are maintained in a ledger.

- The double-entry bookkeeping requires the balance sheet to ensure that the sum of its debit side is equal to the credit side total.

- Thus, the balance at which they end at in the previous accounting period is the balance that is carried forward to the next accounting period on the first day.

- Cash is labeled account number 101 because it is an asset account type.

If separable, then land account different and building account separate, and so on. This sounds like a lot of work, but it’s necessary to keep an accurate record of business events. You can think of this like categorizing events into specific and broader relevant groupings.

Steps in Posting in Accounting

The structure is connected with a special type of lock. As with the lock system, It ensures the facility with safe. Here, a trader can increase or decrease the number of pages according to his requirements.

Cash is an asset that decreases on the credit side. Accounts Payable recognized the liability the company had to the supplier to pay for the equipment. Since the company is now paying off the debt it owes, this will decrease Accounts Payable.

Similarly, if some amount was recorded as balance carried down on the debit side, it will be recorded as balance brought forward on the credit side to start a fresh period. For example, if the purchase account has debit entries of $10000, $5000 and $3000 while credit entires as $1000 and $2000 then the sum will be $18000 and $3000 respectively. As a result, the final balance will be debit minus credit on the last date i.e $15000. The balances of nominal accounts transfer directly to the profit and loss account. The totals at the end of the trial balance need to have dollar signs and be double-underscored.

In the journal entry, Accounts Receivable has a debit of $5,500. This is posted to the Accounts Receivable T-account on the debit side. Service Revenue has a credit balance of $5,500. This is posted to the Service Revenue T-account on the credit side. In the journal entry, Equipment has a debit of $3,500. This is posted to the Equipment T-account on the debit side.

What Method Is Used to Detect Errors When the Two Columns of the Trial Balance Are Not Equal?

A summary showing the T-accounts for Printing Plus is presented in Figure 3.10. Another example is a liability account, such as Accounts Payable, which increases on the credit side and decreases on the debit side. If there were a $4,000 credit and a $2,500 debit, the difference between the two is $1,500. The credit is the larger of the two sides ($4,000 on the credit side as opposed to $2,500 on the debit side), so the Accounts Payable account has a credit balance of $1,500. Recall that the general ledger is a record of each account and its balance.

Is posting and ledger the same?

After the transactions are recorded in the journal, it is then posted in the principal book called as 'Ledger'. The process of transferring the entries from journal to respective ledger accounts is called ledger posting. Balancing of ledgers is carried to find out differences at the end of the year.